The arrival of Martin Doyle in September as deputy chairman

of Paragon Diamonds (LON:PRG) was a fairly low key affair.

But the Scotsman’s vast industry experience – he is a

35-year veteran of De Beers - is already being put to good use quietly behind

the scenes.

Having now taken on the role of chairman, the strategy he is

helping to craft reflects this background.

It marries the processes you’d expect to find at the world’s

largest diamond producer with the junior’s desire to add value at each stage of

the exploration process.

It will also draw on experts in the field of micro-diamond

analysis and resource modelling as Paragon assesses the huge, but as yet

untapped potential of the Lemphane project in Lesotho.

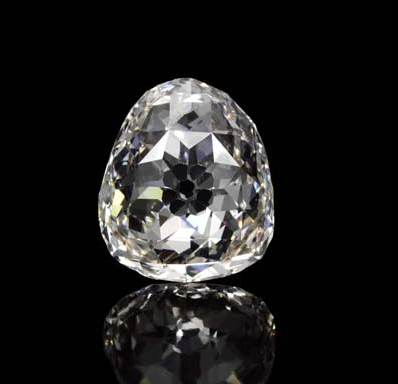

This is a low-grade kimberlite that it is hoped will yield

some very high value stones.

But the plan is also about turning the AIM-listed prospector

into a multi-project play.

So Doyle’s blueprint will also draw on all the other assets

in the Paragon portfolio, though there could be acquisitions to bolster the

pipeline.

The company currently has the promising Kaplamp Lamproite

project in Zambia which “can’t lie there doing nothing” as well as assets in

Botswana and Tanzania.

To date the focus has been on Lemphane, where bulk sampling

work is being carried out, and Motete, a dyke deposit 10 kilometres from the

flagship project.

The most recent news flow has come from Motete, which has

the potential for early cash flow.

While the samples taken so far from the dyke are

encouraging, Doyle believes the company’s cash resources should be spent

bringing potential company-maker Lemphane up to the same stage of development.

“There’s clearly higher-value, larger stones [at Motete] and

the next step in the resource development process would be to increase that

parcel size to 1,000 carats,” Doyle told Proactive Investors.

“However, this is going to cost quite a lot of money. So I

think from a portfolio management viewpoint we have to get Lemphane up to a

similar level of decision-making so we can take an informed decision on both

projects.”

Near-term, the challenge will be bringing Lemphane along the

exploration curve towards resource definition – and this will have its

challenges.

That said it sits in a fairly prolific diamond region with

the world-renowned Letšeng mine less than 30 kilometres away and the promising

Liqhobong deposit almost on the doorstep.

At six hectares it is about the size of the satellite pipe

at Letšeng, which means “the tonnage is there if we can get the [diamond]

valuations”, says Doyle.

“But there are quite a few pitfalls along the way if you don’t

get the sampling right,” the Paragon chairman adds.

“In Lemphane our expectation is the grade will be low. Our

expectation also is there will be high value diamonds.

“We have had some initial indications that this is the case

but nothing concrete.”

So the next year-and-a-half will be spent attempting to firm

up this assertion.

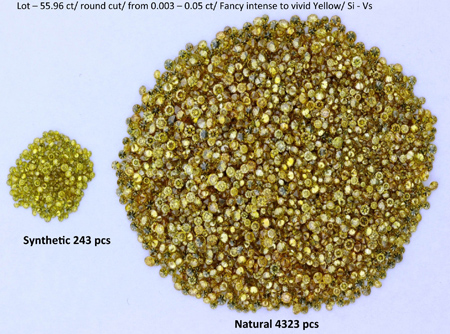

Paragon is currently bulk sampling some 35,000 tonnes of ore

taken from near surface to gain an idea of the potential grade and diamond

quality of Lemphane.

However, Doyle is keen to know about the internal geology of

the pipe – to discover whether the grade and diamond quality continues, and

perhaps even improves, at depth.

This means drilling out samples from deep down in the

kimberlite for microdiamond analysis.

In that endeavour Paragon can call on the expertise of Johan

Ferreira, a leading light in this specialist area of resource estimation.

A team directed by Matthew Field of AMEC, another world

renowned figure in his field, will be used to define the size and extent of the

resource.

“This will give us a picture of the internal geology of the

pipe. It will also give us better

certainty of its shape and depth and therefore its tonnage,” says Doyle.

A contractor will carry out an initial 2,000 metres of

drilling although the group is hoping to acquire its own rig.

Paragon will also look to assess the liberation

characteristics of the kimberlite in order to anticipate potential diamond

recovery challenges before going into production.

The crucial juncture will come at some point next year when

the group has to decide whether to take a bulk sample from lower down the

kimberlite.

To establish the diamond value assortment could potentially

be a large and quite expensive undertaking in a low grade kimberlite, although

modern sampling and statistical techniques can reduce this.

“How to actually do this we have not decided at this point,”

Doyle says.

Just to get to this resource definition stage is likely to

cost US$4.5mln, and the bulk sample “at least as much again”, the Paragon

chairman reveals.

An alternative might be a trial mining period as part of a

planned lead-in to full scale production.

The company is still assessing how it will finance the work

required just to get to resource definition at Lemphane.

But on funding Doyle is a pragmatist. “If you don’t have the

money to execute the project properly, don’t even start,” he says.

“You might have three-quarters of the money. Still don’t

start. You won’t have the answers people want.

“You want to put the portfolio together in a way that it is

only advanced with properly informed decision making. That way there is no

re-work or recycling.”

Meanwhile, defining a resource may actually prove to be an

end in itself.

“We are a finder and developer. We don’t currently have the

full team with experience of building and running [a large mine],” says Doyle,

although that can obviously be changed.

“We have to determine what we want to be. And I think we want

to be a resource developer. The real value creation for companies and

shareholders comes at the early stage of development.”