| Rockwell

Diamonds reported that combined production at its Saxendrift, Klipdam

and Tirisano projects in South Africa rose 12 percent year on year to

5,950 carats in the third fiscal quarter that ended on November 31,

2012. The company noted that the increase came despite operational

challenges and ongoing industrial action at its Tirisano mine. Production at Saxendrift rose 26 percent to 2,444 carats with 633 carats recovered at the Saxendrift bulk x-ray project. However, production at Tirisano fell 69 percent to 1,244 carats, while Klipdam yielded 1,975 carats, down 9 percent from one year ago. "Our overall throughput and diamond production volume are consistently tracking closer to expectations," said James Campbell, Rockwell's chief executive. During the quarter, the company signed a three-year mining agreement with CML to outsource mining operations at its Klipdam mine in an effort to reduce high unit costs and improve earth-moving capabilities. This resulted in the mine exceeding its objectives, Rockwell said. Since the quarter closed, the company placed its Tirisano mine on care and maintenance in early December due to persistent industrial action and continuous financial losses, which resulted from a slower than anticipated recovery in the price of smaller diamonds that accounts for much of Tirisano’s production. A total of 381 carats were recovered at the mine during the quarter. |

|

| Source:diamonds.net | |

Over 10,000 Sierra Leoneans are illegally

mining diamonds in the country, the United Nations Panel of Experts on

Liberia has reported. According to the Panel in its final report

submitted to the UN Security Council early December 2012:"The Panel

estimates that the number of Sierra Leonean miners in Liberia is now in

excess of 10,000."

"As the Panel stated in its midterm report, many of the diggers

operating illegally in the sector have crossed the border from Sierra

Leone with financial backing from diamond brokers in Kenema," said the

Panel's report. The report indicates that the illegal Sierra Leoneans

miners compete with Liberians for both mining ground and logging areas,

adding that in this case, the potential for territorial conflict between

the Sierra Leoneans and Liberians remains significant.

The UN Panel of Experts says it is concerned about "several reports

from industry sources that have complained that the influx of Sierra

Leonean miners continues unabated, and, as the Panel reported,

legitimate Liberian diamond miners have been threatened when they have

attempted to move squatters off their claims."

The Panel of Experts report, which covered Liberia's alluvial diamond

mining sector and security condition, states that much of the illegal

diamond mining in Liberia is taking place in Grand CapeMount, Gbarpolu

and Lofa counties, adjacent to the country's borders with SierraLeone,

Guinea and Côte d'Ivoire.

The report details that specifically, such illegal mining activities

are carried out within areas that have close proximity with markets

inKenema and Koidu, in Sierra Leone, adding that these areas encourage

trafficking, particularly as thosemarkets are larger and more vibrant

than those in the interior parts of Liberia.

"During the course of interviews with diamond miners in western

Liberia, the Panel learned that markets in Sierra Leone often pay higher

prices for diamonds than those in Monrovia [Liberia's capital]', the UN

Panel of Experts report noted, adding that: "The temptation to traffic

is further increased when the difficulty and cost of transportation to

Monrovia or even regional offices is factored in."

The report avers that the scenario of increased difficulty and cost

of transportation is particularly true for areas in the remote

north-western part of Liberia, which the report says are often much

closer to Sierra Leonean markets than to Liberian ones.

The

third highest-grossing lot of Monday’s sale was a modified cushion-cut,

6.18-carat Burmese ruby ring in 18-karat gold. A member of the European

trade paid $1.7 million for the ring, with features a bezel-set ruby

surrounded by baguettes.

The

third highest-grossing lot of Monday’s sale was a modified cushion-cut,

6.18-carat Burmese ruby ring in 18-karat gold. A member of the European

trade paid $1.7 million for the ring, with features a bezel-set ruby

surrounded by baguettes.

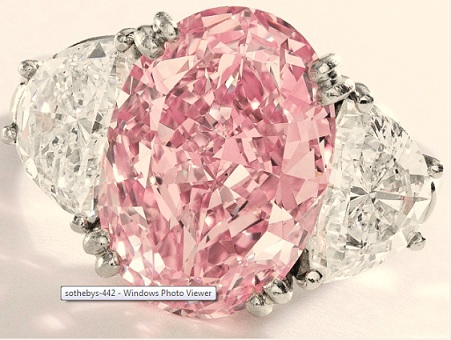

ed),

a 6.54 carat, fancy intense pink, internally flawless diamond ring by

Oscar Heyman & Brothers that belonged to Evelyn Lauder, which sold

for $8.6 million or $1,313,144 per carat. A 52.73 carat, fancy vivid

yellow, VVS1 diamond ring achieved $3.9 million or $73,781 per carat

while a 22.16 carat D, potentially flawless type IIa diamond ring by

Graff sold for $3.4 million or $155,347 per carat.

ed),

a 6.54 carat, fancy intense pink, internally flawless diamond ring by

Oscar Heyman & Brothers that belonged to Evelyn Lauder, which sold

for $8.6 million or $1,313,144 per carat. A 52.73 carat, fancy vivid

yellow, VVS1 diamond ring achieved $3.9 million or $73,781 per carat

while a 22.16 carat D, potentially flawless type IIa diamond ring by

Graff sold for $3.4 million or $155,347 per carat.