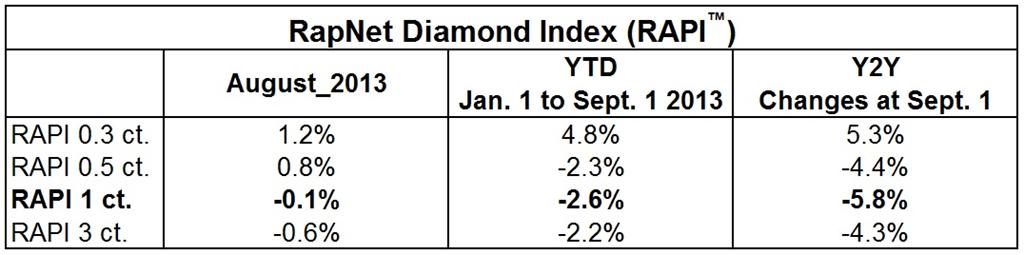

The RapNet Diamond Index (RAPI™) for 1-carat certified polished diamonds fell 0.1 percent in August. RAPI for 0.30-carat diamonds rose 1.2 percent during the month, while RAPI for 0.50-carat diamonds increased 0.8 percent. RAPI for 3-carat diamonds fell 0.6 percent.

The index is down from the beginning of the year after prices dropped in June and July. There is resilient demand for lower price points, with 0.30 to 0.40-carat, H-, VS-SI diamonds remaining the strongest category. RAPI for 0.30-carat diamonds increased by 4.8 percent in the first eight months of the year due to steady U.S. and Chinese demand for these goods.

Copyright © by Martin Rapaport.

According to the just released Rapaport Monthly Report – September 2013, “Liquidity Crunch,” the weak rupee continues to impact global diamond trading. There is rising expectation that India-based polished suppliers will reduce their prices at the September Hong Kong show in an effort to generate cash flow. India’s domestic market stalled as the rupee plummeted to a historic low of 69.22/$1, declining by more than 8 percent in August, while rupee-based gold prices hit a record high.

Chinese demand is selective with increasing demand for lower-quality diamonds at competitive price points and more buyers moving to memo. U.S. demand is stable with decent demand expected to continue during the fourth quarter.

Tight liquidity has forced manufacturers to refuse high-priced rough supply. Sightholders reportedly rejected 20 to 25 percent of approximately $600 million worth of rough on offer at the De Beers August sight. While De Beers reduced prices on cheaper Indian boxes, average prices were basically stable. There is very little activity on the secondary rough market with dealers giving long- term credit in order to offload goods.

“Rough prices are unsustainable because buyers will inevitably run out of money in the current market environment. Manufacturers should, and inevitably will, continue to refuse high-priced rough. Their inability to profit has resulted in less available credit and less liquidity. Miners are raising prices and rough is ahead of the polished. So why manufacture diamonds when it is so hard to make money? It's better to just buy polished,” said Martin Rapaport, Chairman of the Rapaport Group.

Source: Rapaport

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.