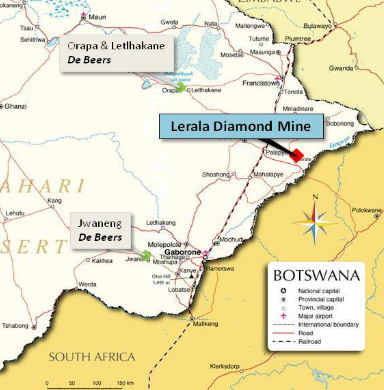

Mantle Diamonds owns the Lerala diamond mine, situated 50 kilometers west of the Martin’s Drift Border Post with South Africa in eastern Botswana. The mine hosts five diamondiferous kimberlite pipes that were discovered by De Beers in the early 1990s. Indicated resource estimates were about 3.1 million carats and probable reserves were nearly 2.5 million carats.

Reportedly, Mantle and partner DiamonEx Ltd. undertook a substantial refurbishment of the plant and equipment, focusing on critical engineering modifications to optimize processing and security. Kimberley Diamonds stated that even though Lerala stands ready to be recommissioned, it requires engineering improvements that must further enhance recovery and reduce operating costs since it hopes to restart mining in 2014 with a production target of 400,000 carats per year. Upgrades that will receive priority, subsequent to the completion of the transaction, are estimated to cost $10 million and include:

<> Purchasing a new diamond sorter to replace outdated technology and improve recovery;

<> Purchasing an optical waste sorter to improve the throughput capacity of the plant; and

<> Replacing the diesel power generators with a link to Botswana’s national power grid.

Once this transaction is completed, Kimberley Diamonds expects to acquire Mantle's 34 percent stake in a joint venture with Firestone Diamonds at the diamondiferous Lahtojoki kimberlite project in Finland along with the Slave and Superior projects near the Ekati diamond mine in Canada.

Alex Alexander, Kimberley Diamonds' chairman, said, “The acquisition provides Kimberley Diamonds with a strong foundation for the company’s growth ambitions, including its objective to become a world class diamond producer – with multiple operating mines, supported by longer term life extension opportunities. We aim to consistently acquire projects with promising prospects at attractive valuations, with significant upside potential that can be realized quickly and cost effectively. Lerala has all of these qualities and represents an important incremental step in the company’s growth.”

Source: Diamonds.net

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.